- 2023 order book turnover grew 9% on 2022

- Volume of securities traded reached 1.62bn, an increase of 14% on 2022

- Milestone achievements set the groundwork for future growth

Spectrum Markets ("Spectrum"), the pan-European trading venue for securities, has released its Full Year 2023 Business Update revealing continued growth despite more challenging market conditions and a wider trading uncertainty.

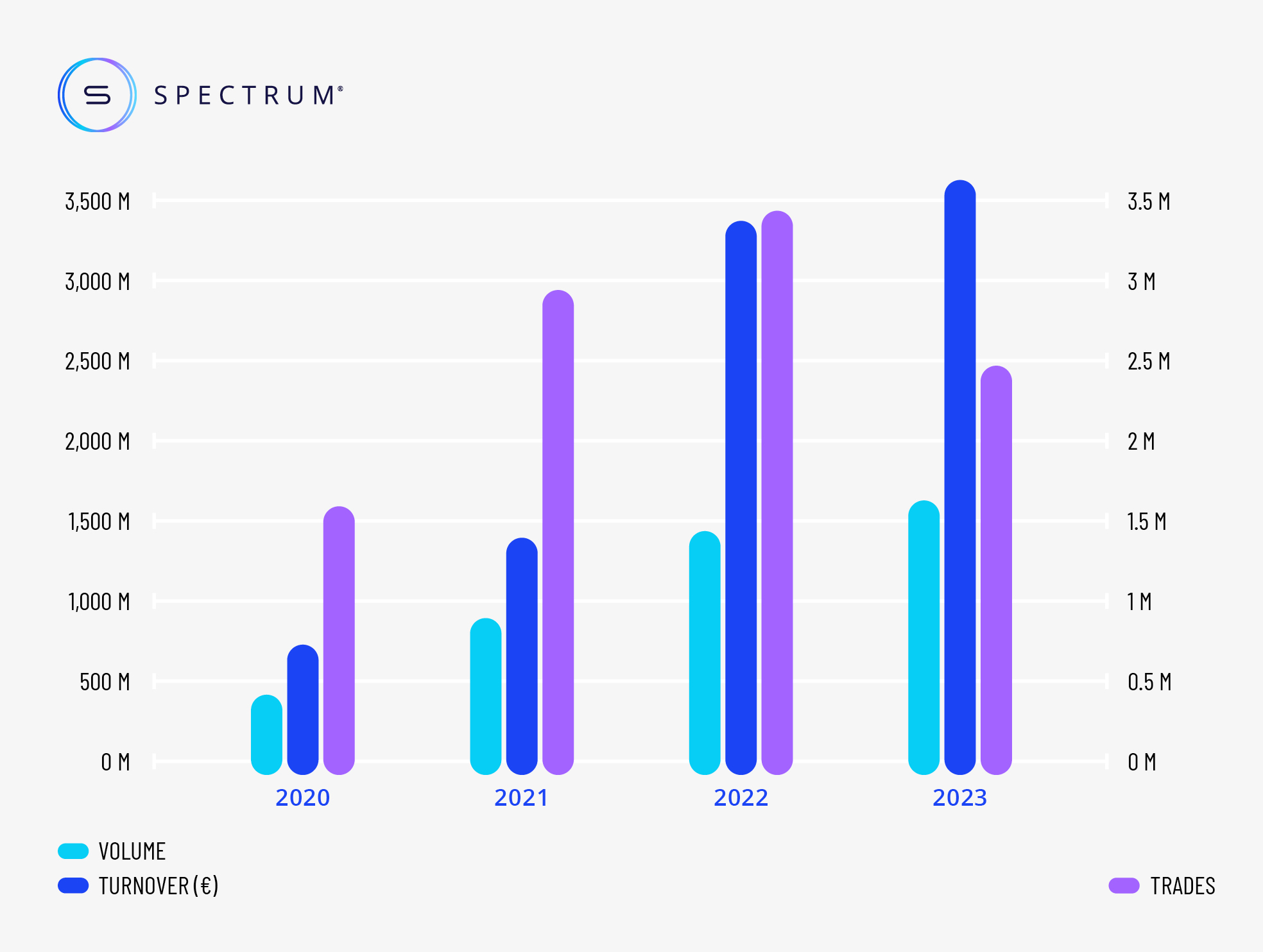

Trading volume for the year grew by 14%, with 1.62 billion securities traded in 2023 compared to 1.42 billion the year before. This volume was executed across nearly 2.5 million trades, with 33.9% of those taking place outside of traditional hours (i.e. between 17:30 and 9:00 CET).

Spectrum reported a 9% increase in the total value of order book turnover compared to the previous year, hitting €3.62 billion in 2023.

During 2023, which was Spectrum’s fourth full calendar year in business, the firm unveiled several important initiatives and milestones, including welcoming UniCredit Bank GmbH as a member of the venue, making a range of warrants and constant leverage warrants accessible to retail investors via their broker or bank.

With three issuers now live on the venue, the number of instruments available on Spectrum to retail traders across Europe has increased by more than six times, year on year.

Another key partnership saw independent Italian retail broker Directa join Spectrum, allowing more retail investors to trade securities, 24 hours a day, five days a week. Additionally, in a strategic move, Spectrum signed a collaboration with ICE Data Services Italy, a subsidiary of Intercontinental Exchange, Inc. (NYSE: ICE), making Spectrum's reference data more broadly accessible across financial platforms.

Lastly, Spectrum joined two key European industry associations: becoming a supporting member of the German Structured Securities Association (Bundesverband für strukturierte Wertpapiere - BSW), underpinning the association's work for structured products; and an associate member of the Italian Association of Certificates and Investment Products (ACEPI), expanding its commitment to collaborate closely with securities associations in Europe.

Together, these partnerships represent a significant next step for Spectrum’s ongoing growth strategy, expanding the range of products available and making these accessible to more investors more easily, allowing trading via a single pan-European ISIN, through which investors benefit from a deeper liquidity pool.

“2023 posed many challenges for the trading and investment space, with declining volumes seen across the industry, so I’m really pleased that Spectrum’s performance remained relatively robust, with our volumes showing notable resilience and continuing to increase from last year. We’ve made great progress on our long-term growth plans, notching up another record year, which is a testament to the hard work of the whole Spectrum team, and the ongoing support of our partners and members,” said Nicky Maan, Spectrum Markets CEO.

“Looking ahead to 2024, our focus remains on enhancing and expanding our venue by improving connectivity options and trading infrastructure, as well as welcoming more members to the venue,” he adds.

In 2023, 84.3% of the traded securities were on indices, 9.9% on currency pairs, 4.1% on commodities, 1.5% on equities, and 0.2% on cryptocurrencies. The most traded underlyings last year were DAX 40 (29.4%), NASDAQ 100 (20.2%) and S&P 500 (18.9%).

About Spectrum Markets

Spectrum Markets is a pan-European trading venue for securities aimed at financial institutions and their retail investors. Headquartered in Frankfurt am Main, Germany, and with presence across Europe, Spectrum Markets was designed for transparency, integration and openness while enabling unparalleled access to the markets beyond traditional trading hours with 24/5 on-venue trading for the first time in Europe.

Since launch in August 2019, securities listed on Spectrum Markets have been made available for retail trading in Germany, Italy, France, Spain, Sweden, Norway, the Netherlands, Ireland, Finland, and Cyprus.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, Spectrum Markets uses a uniquely open architecture, allowing intermediaries and product providers to offer to retail investors a unique trading experience with increased choice, control and stability.

Being an MTF (Multilateral Trading Facility), Spectrum Markets provides access to innovative products designed to give European retail traders flexibility and control over their trades. This includes Turbo24, the world’s first 24-hour turbo warrant.

Through the pan-European ISIN, 24/5 trading services, intraday issuance and a fully proprietary venue, Spectrum Markets enables a guaranteed baseline level of liquidity over a range of products, is able to swiftly and safely match a significant number of orders, and to process messages with a low latency.

Spectrum Markets publishes SERIX® – the Spectrum European Retail Investor Index – a pan-European client sentiment that informs as to whether retail investors have speculated on a bullish or bearish view on a specific underlying. SERIX® is a measure based on trades made by retail investors across Europe which can be used to compare how sentiment has changed (in terms of directionality or strength of sentiment) over time on a monthly basis.

Spectrum Markets is a wholly owned subsidiary of IG Group (LSEG: IGG).

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcomms.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.