- Record high of 787m securitised derivatives traded in Η1 2023 vs. 657m in Η1 2022

- UniCredit Bank AG joined Spectrum in May, listing a range of products on the trading venue

- Number of available instruments on Spectrum has grown to nearly 18,000

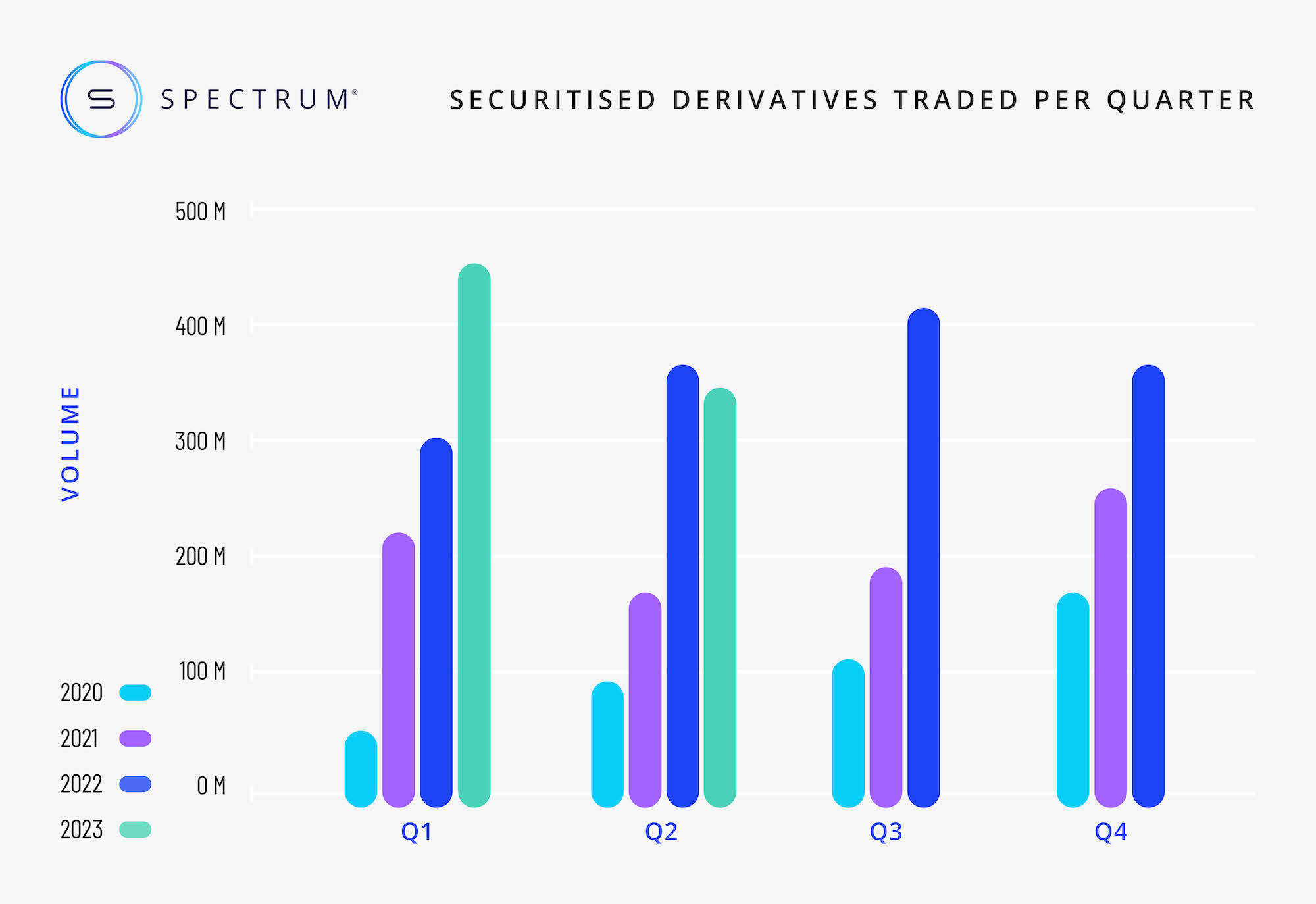

Spectrum Markets ("Spectrum"), the pan-European trading venue for securitised derivatives, has released its second Quarterly Business Update of the year, revealing a dip in activity in Q2 against a backdrop of low volatility in equity markets, though trading levels for the first half of the year remain positive.

Spectrum saw the number of securitised derivatives traded from April to June hit just over 340 million, a little below the 357 million recorded during the same period last year. This came amidst a wider pull-back in trading experienced across the industry, and the relatively small decline underlines Spectrum’s continued resilience.

Looking at the first half of the year as a whole, the volume of securitised derivatives traded on Spectrum remains positive at 787 million, an increase of around 20% on the 657 million traded in H1 2022. Additionally, Spectrum reported the total value of its order book turnover reached €1.77 billion in H1 2023, compared to €1.65 billion in H1 2022.

Spectrum also highlighted that the number of instruments available on the venue has increased to nearly 18,000 ISINs as it continues to increase the types of product available and the number of tradable underlyings.

The positive numbers come as Spectrum pursues its longer-term growth strategy, with more products now listed on the venue, and more retail investors around Europe trading on Spectrum every month, including those coming via new members and other partnerships announced during the course of the last year.

In May, Spectrum announced UniCredit Bank AG as its newest member. The pan-European bank listed a series of constant leverage warrants and covered warrant products on the trading venue, making these available to retail investors in Germany via their broker or bank.

Then, in June, Spectrum became a supporting member of the German Derivatives Association (DDV), the industry representative of the leading issuers of structured securities in Germany, to underpin the association's work for retail structured products. The membership comprises a significant strategic step forward for the venue as it is opening up the opportunity to participate in, and contribute to, industry committees and working groups on regulatory initiatives and to share expertise developed from the pan-European trading network.

“As Spectrum enters the second half of the year, the business remains focused on driving innovation, and we continue to invest heavily in enhancing and expanding the foundations of our pan-European trading ecosystem and remaining at the forefront of retail trading in Europe,” explains Nicky Maan, Spectrum Markets CEO.

“We’ve seen a drop in trading during the last three months, which isn’t a huge surprise considering the wider market environment right now. But I’m pleased that, overall, with the record quarter we experienced in Q1, volume is still up for the first half of the year. We remain committed to continuously delivering the best possible trading experience for our valued clients, exploring new partnerships and expanding our offering.”

During Q2 2023, 35.3% of individual trades took place outside of traditional hours (i.e., between 17:30 and 9:00 CET). 79.2% of the traded securitised derivatives were on indices, 14.9% on currency pairs, 4.1% on commodities, 1.5% on equities, and 0.3% on cryptocurrencies with the most traded underlyings being DAX 40 (25.3%), S&P 500 (20.8%), and NASDAQ 100 (18.8%).

About Spectrum Markets

Spectrum Markets is the trading name of Spectrum MTF Operator GmbH. Headquartered in Frankfurt am Main, Germany, it is a pan-European trading venue for securitised derivatives aimed at financial institutions and their retail investors. Since launch, trading has been available in: Germany, France, Italy, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, the exchange uses a uniquely open architecture system to allow investors to trade with increased choice, control and stability. Through its pan-European ISIN, 24/5 trading services and its own proprietary venue, Spectrum enables a guaranteed baseline level of liquidity over a range of products and is able to swiftly and safely match a significant number of orders and process multiple quotes every second.

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcommunications.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.