- Spectrum saw an improvement in sentiment towards Yen against US Dollar, Euro and Pound Sterling

- Sentiment index on the Nikkei 225 also indicated bullish trading behaviour

- 64.4% of trading on the Nikkei 225 occurred outside of traditional European trading hours

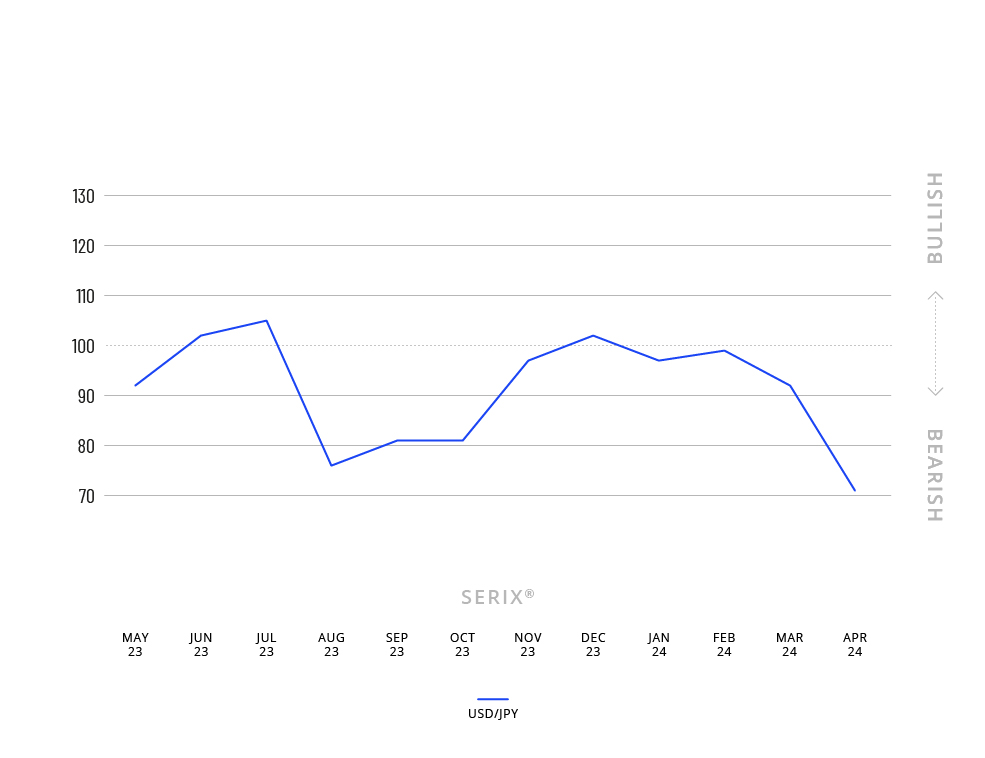

Spectrum Markets (“Spectrum”), the pan-European trading venue designed for retail investors, has published its SERIX sentiment data for European retail investors for April. The sentiment index reveals a bullish trading behaviour towards the Japanese Yen, relative to the US Dollar, with sentiment on USDJPY falling to 71, marking its lowest level since November 2019.

This development is also noticeable in other Yen currency pairs, such as against the Euro and British Pound. The retail investor sentiment index directly correlates with the Yen price, which recovered at the end of April after a record low, equivalent to the value of 0.0063 US Dollars on April 26th.

Additionally, Spectrum’s retail investor sentiment index saw bullish trading behaviour towards the leading Japanese index, Nikkei 225.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion

“In recent months, the Yen experienced a notable decline against the US Dollar, but towards the end of April, it showed a brief recovery, possibly in response to early indications of upcoming interest rate hikes by the Bank of Japan,” says Michael Hall, Head of Distribution at Spectrum Markets.

“One of the primary factors contributing to the Yen’s decline has been Japan’s monetary policy. While western central banks have been consistently raising key interest rates to combat inflation, the Bank of Japan has marginally increased its key interest rate from -0.1% to a range of 0%-0.1% last month. This was a decision which was anticipated since Bank of Japan Governor Kazuo Ueda took office in April last year,” Hall adds.

“Interestingly, Spectrum saw 64.4% of trading on the Nikkei 225 in April occur outside of traditional European trading hours last month, underscoring the demand we are seeing among European retail investors for 24/5 trading to access international markets,” he concludes.

Spectrum’s April data

In April 2024, order book turnover on Spectrum was €311 million, with 36.9% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

75.9% of the order book turnover was on indices, 14.3% on commodities, 3.8% on equities, 3.1% on currency pairs and 2.9% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (26.3%), NASDAQ 100 (21.1%), and DOW 30 (10%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 sentiment increased slightly from a bearish 95 to a bullish 101. Similarly, the NASDAQ 100 increased slightly from a neutral 100 to 101 and the DOW 30 increased also, from a bearish 99 to a bullish 103.

Calculating SERIX® data

The Spectrum European Retail Investor Index (SERIX®), uses the trading venue’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX® = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

About Spectrum Markets

Spectrum Markets is a pan-European trading venue for financial instruments aimed at financial institutions and their retail investors. Headquartered in Frankfurt am Main, Germany, and with presence across Europe, Spectrum Markets was designed for transparency, integration and openness while enabling unparalleled access to the markets beyond traditional trading hours with 24/5 on-venue trading for the first time in Europe.

Since launch in August 2019, financial instruments listed on Spectrum Markets have been made available for retail trading in Germany, Italy, France, Spain, Sweden, Norway, the Netherlands, Ireland and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, Spectrum Markets uses a uniquely open architecture, allowing intermediaries and product providers to offer to retail investors a unique trading experience with increased choice, control and stability.

Being an MTF (Multilateral Trading Facility), Spectrum Markets provides access to innovative products designed to give European retail traders flexibility and control over their trades. This includes Turbo24, the world’s first 24-hour turbo warrant.

Through the pan-European ISIN, 24/5 trading services, intraday issuance and a fully proprietary venue, Spectrum Markets enables a guaranteed baseline level of liquidity over a range of products, is able to swiftly and safely match a significant number of orders, and to process messages with a low latency.

Spectrum Markets publishes SERIX® – the Spectrum European Retail Investor Index – a pan-European client sentiment that informs as to whether retail investors have taken exposure on a bullish or bearish view on a specific underlying. SERIX® is a measure based on trades made by retail investors across Europe which can be used to compare how sentiment has changed (in terms of directionality or strength of sentiment) over time on a monthly basis.

Spectrum Markets is a wholly owned subsidiary of IG Group (LSEG: IGG).

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcomms.com

Disclaimer

All information contained herein is for information purposes only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any financial instrument(s) listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokerage. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.