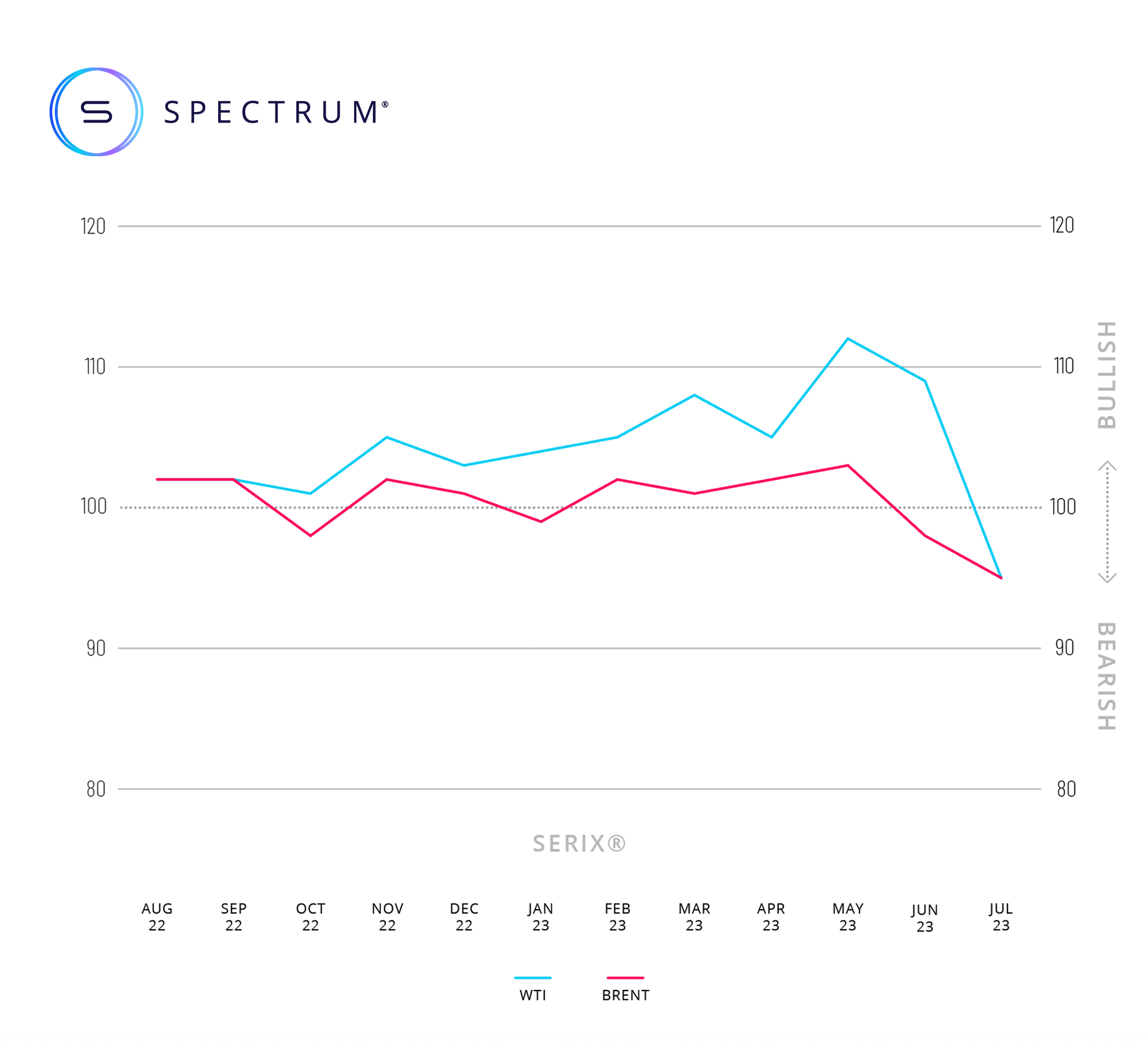

- Trend in the monthly sentiment barometer SERIX® counters development of the oil prices

- SERIX® value for WTI fell by 14 points in one month, landing in bearish territory at 95

- Sluggish economic activity could be making retail investors cautious

Spectrum Markets ("Spectrum"), the pan-European trading venue for securitised derivatives based in Frankfurt, measures the sentiment of retail investors towards various underlying assets via its sentiment indicator SERIX®. These include indices, currency pairs, cryptocurrencies and commodities.

What is striking in July is the contrary trend in retail investor sentiment compared to the positive development of the oil prices. In July crude oil prices saw the sharpest rise in the last one and a half years, and reached their highest level in three months. Previously, crude oil prices fell by almost a fifth in the past twelve months due to the weak global economic situation amid rising interest rates.

Meanwhile, retail investor sentiment data for oil investment has steadily deteriorated over the past three months. The value for WTI fell from 112 in May to 109 in June and a further 14 points in July to 95. The value for Brent was negative 95 in July, 98 in the previous month and positive 103 in May.

The Spectrum European Retail Investor Index (SERIX®) uses pan-European data from the trading venue to shed light on investor sentiment towards current developments in the financial markets.

Trades executed by retail investors are analysed on a monthly basis and the share of trades with a bearish trend is subtracted from the share of trades with a bullish trend, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment. Trades with a bullish tendency are purchases of long instruments and sales of short instruments. Sales of long instruments and purchases of short instruments are attributed to the bearish trend. Trades that are matched by retail clients are disregarded.

Market opinion

The market is currently speculating on the impact of large-scale support measures for the Chinese economy, with Chinese authorities announcing a new package of measures at the end of July to boost sales of cars and electronics in particular. In addition to hopes of economic stimulus from China that could support rising demand for oil, the tightening of supply is also evident.

OPEC+ member countries, which currently control 40 per cent of the global oil market, have cut production to stabilise prices. One reason that the production cuts are not having its intended impact on the market is that, according to OPEC's monthly report, oil production by non-member states representing the remaining 60% increased by around 1.4 million barrels per day in 2023, with the USA, Brazil, Norway, Canada, Kazakhstan and Guyana producing the lion’s share.

"Despite analysts expecting supply to tighten in the second half of the year, recession fears and the sluggish economic recovery in China are currently dominating the mood in the oil market," explains Michael Hall, Head of Distribution at Spectrum Markets.

In addition, US oil companies, among others, are struggling with declining investor interest, which is partly due to a stronger focus on sustainability.

"Longer term, some of the key market factors affecting prices suggest a less rosy outlook for oil and retail investors seem to be responding with caution," adds Michael Hall.

Publication Spectrum July data

In July 2023, 101 million securitised derivatives were traded on Spectrum, with 32.9% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

83.7% of the traded derivatives were on indices, 10.7% on currency pairs, 3.4% on commodities, 2% on equities and 0.2% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (32.8%), NASDAQ 100 (19.7%), and S&P 500 (13.2%).

Looking at the SERIX® data for the top three underlying markets, the DAX 40 increased from 97 to 99, the NASDAQ 100 remained bearish at 98 from 97, and the S&P 500 increased marginally from its record low of 88 to 89.

About Spectrum Markets

Spectrum Markets is the trading name of Spectrum MTF Operator GmbH. Headquartered in Frankfurt am Main, Germany, it is a pan-European trading venue for securitised derivatives aimed at financial institutions and their retail investors. Since launch, trading has been available in: Germany, France, Italy, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, the exchange uses a uniquely open architecture system to allow investors to trade with increased choice, control and stability. Through its pan-European ISIN, 24/5 trading services and its own proprietary venue, Spectrum enables a guaranteed baseline level of liquidity over a range of products and is able to swiftly and safely match a significant number of orders and process multiple quotes every second.

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcommunications.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.